Each year, tax refunds give many American families an important financial lift. For some households, a refund helps pay rent, reduce credit card balances, build savings, or handle planned expenses. As the 2026 tax season continues, knowing how the refund process works can make it easier to plan ahead and avoid unnecessary worry.

When the IRS Started Processing 2026 Returns

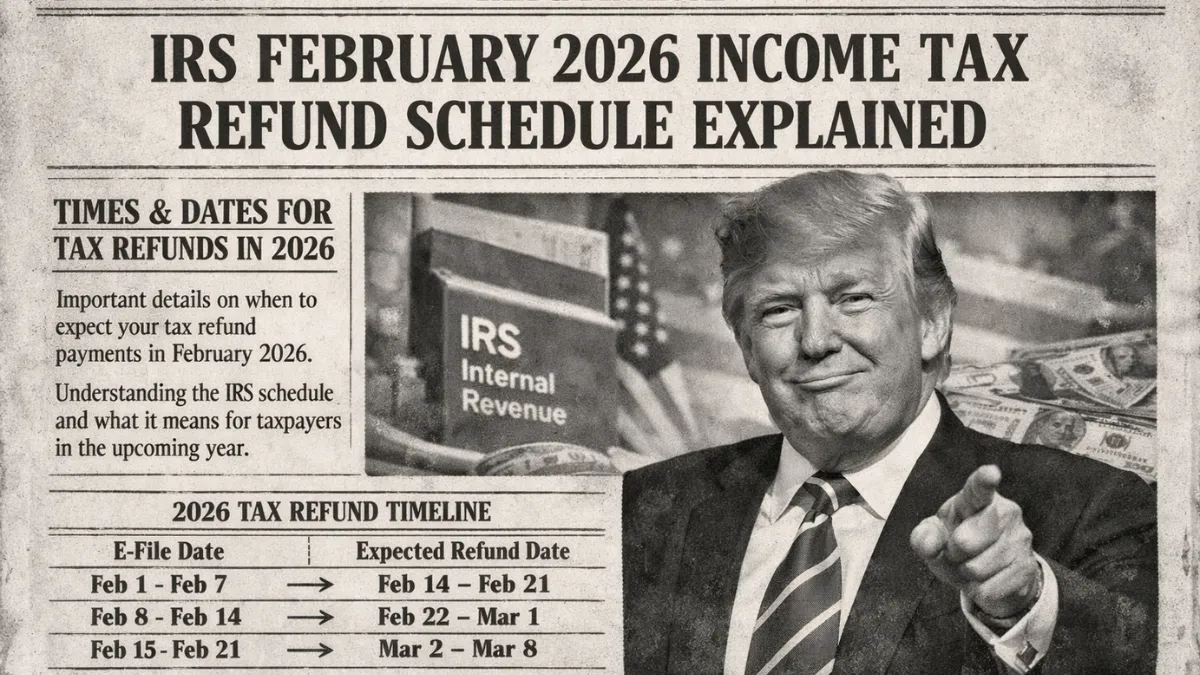

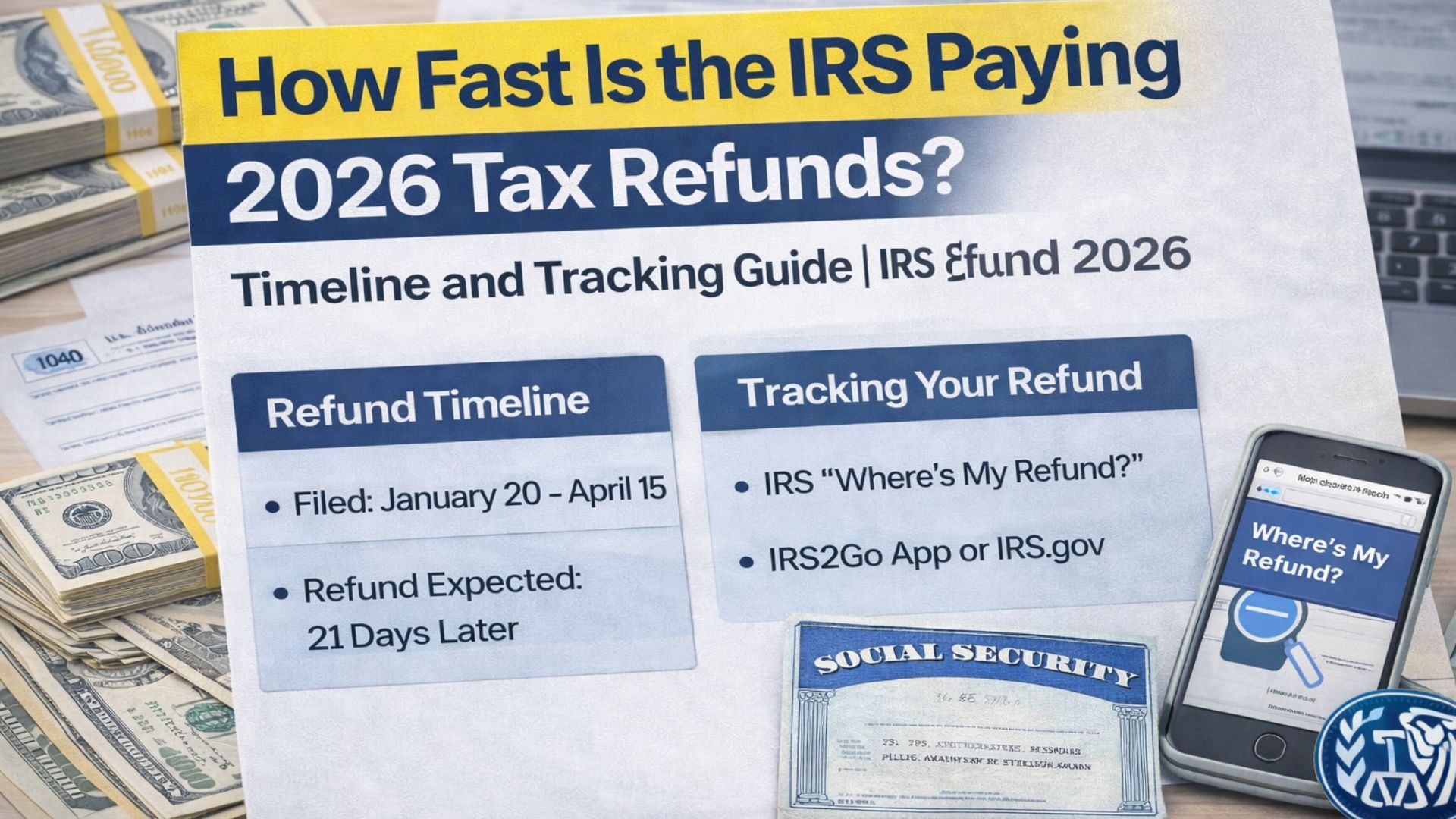

The Internal Revenue Service began accepting 2025 tax year returns in late January 2026. Once a return is officially accepted, the processing period begins. For most taxpayers who file electronically and choose direct deposit, refunds are typically issued within about 21 days. This timeline is an average, not a guarantee, but it reflects how long simple and accurate returns usually take.

Electronic filing allows tax information to move quickly through IRS systems. Direct deposit also speeds up delivery because the money goes straight to a bank account without postal delays.

What Affects Refund Timing

Refund timing depends on several factors. The date you file is important. Taxpayers who file early often receive refunds earlier, while those who file later may wait longer due to higher processing volumes. The method of filing also matters. Paper returns require manual handling, which can extend the timeline by several weeks.

The type of credits claimed can also affect processing time. Returns that include the Earned Income Tax Credit or the Additional Child Tax Credit are subject to additional review. Federal law requires the IRS to hold these refunds until at least mid-February to verify details and reduce fraud. As a result, eligible filers often see their payments later in February rather than at the beginning of the month.

Common Reasons for Delays

Although most refunds are processed without issues, certain problems can slow things down. Incorrect Social Security numbers, mismatched income records, missing forms, or identity verification checks may trigger additional review. Even small mistakes can extend the processing period beyond the usual 21 days.

How to Track Your Refund

Taxpayers can check refund status using official IRS tracking tools. Information becomes available about 24 hours after electronic filing or several weeks after mailing a paper return. The system typically shows three stages: return received, refund approved, and refund sent.

Tips for Faster Processing

Filing early, reviewing your return carefully, and selecting direct deposit remain the best ways to receive your refund quickly. While many refunds are issued within three weeks, allowing extra time for possible reviews is always wise.

Disclaimer:

This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund amounts and timelines depend on individual tax circumstances and official IRS processing guidelines. Always consult official IRS resources or a qualified tax professional for personalized advice.