As the 2026 tax season approaches, millions of Americans are preparing to file their federal income tax returns for the 2025 tax year. For many households, a tax refund plays an important financial role. It may be used to pay rent, manage utility bills, reduce debt, or cover school and medical expenses. Understanding how the refund process works can help families plan their budgets with greater confidence.

When the 2026 Tax Filing Season Begins

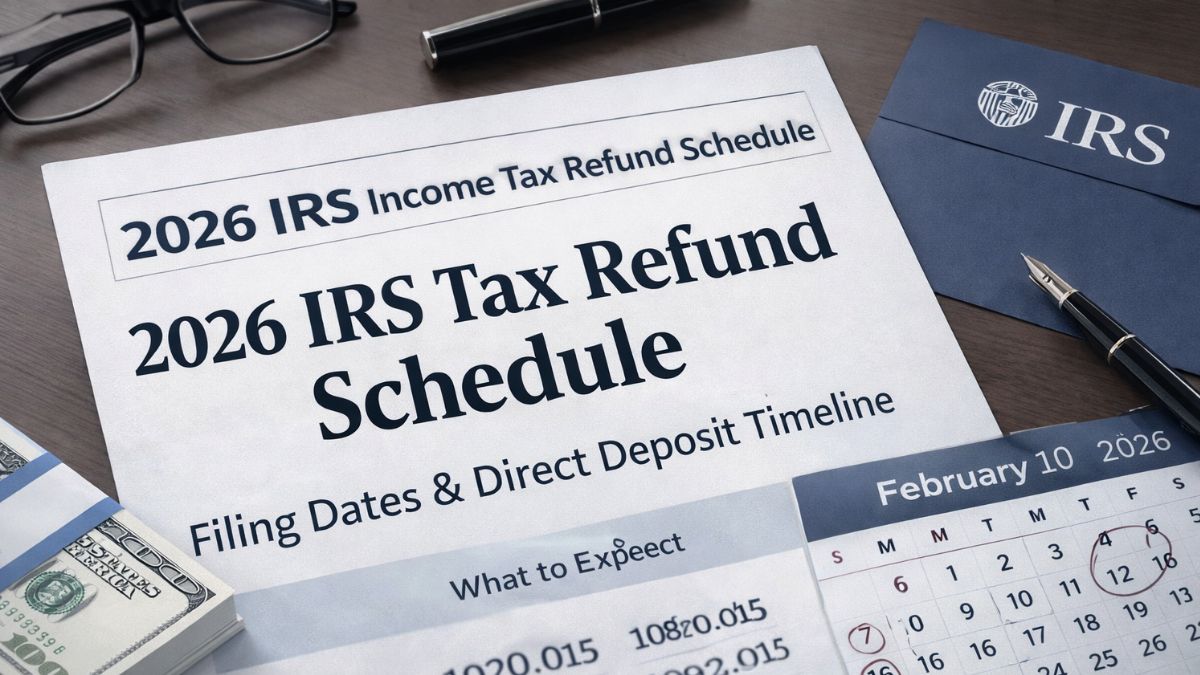

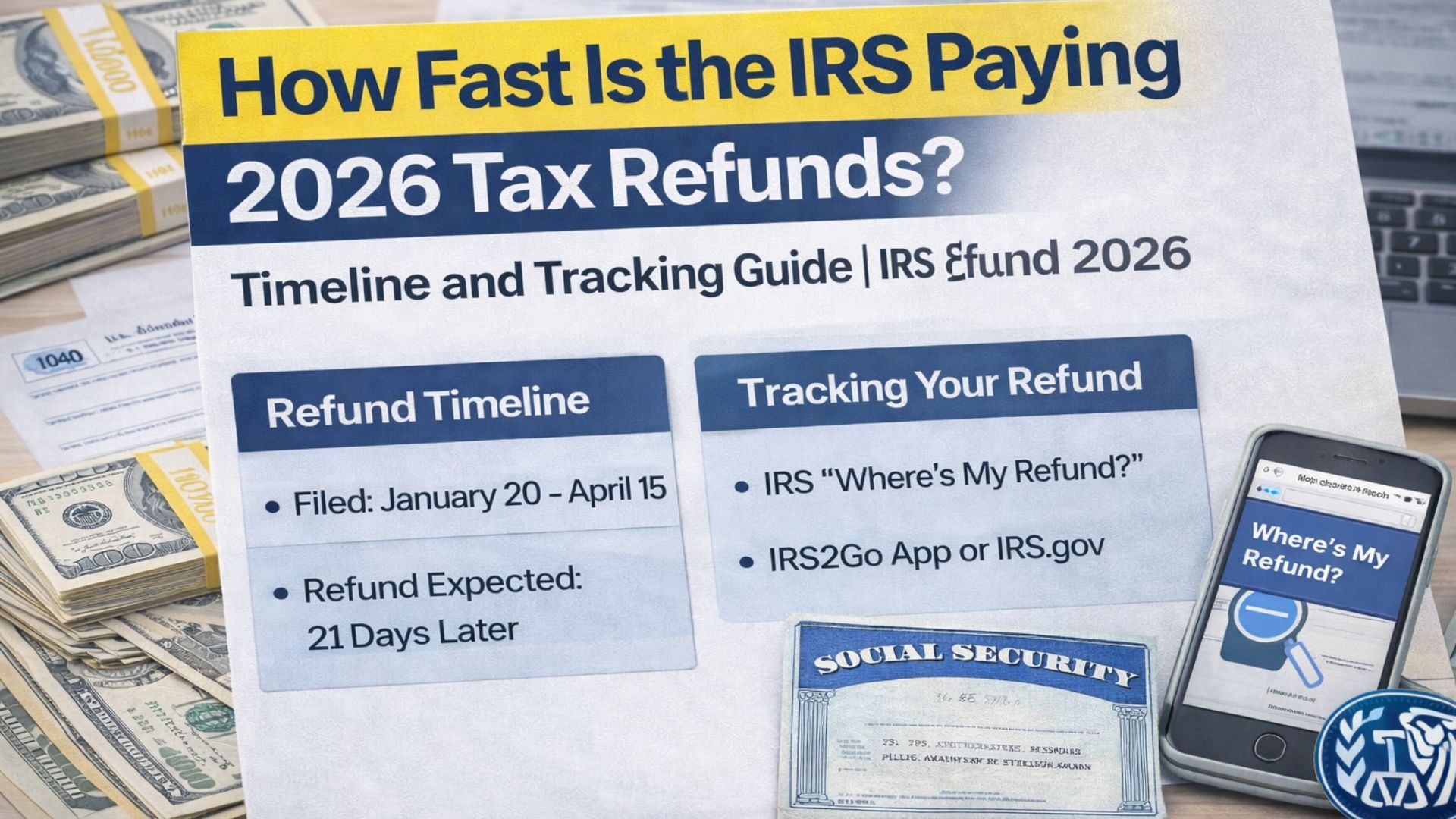

The federal tax filing season usually opens in the final week of January. In 2026, the Internal Revenue Service is expected to begin accepting tax returns around that time. Although taxpayers can prepare their returns earlier using tax software or professional services, the IRS cannot process them until the official opening date. Filing early places your return closer to the front of the processing line once the system opens.

The general filing deadline for most taxpayers will be April 15, 2026. While it is acceptable to file closer to the deadline, submitting your return earlier can reduce stress and provide extra time to correct any possible errors.

How Refund Timing Works

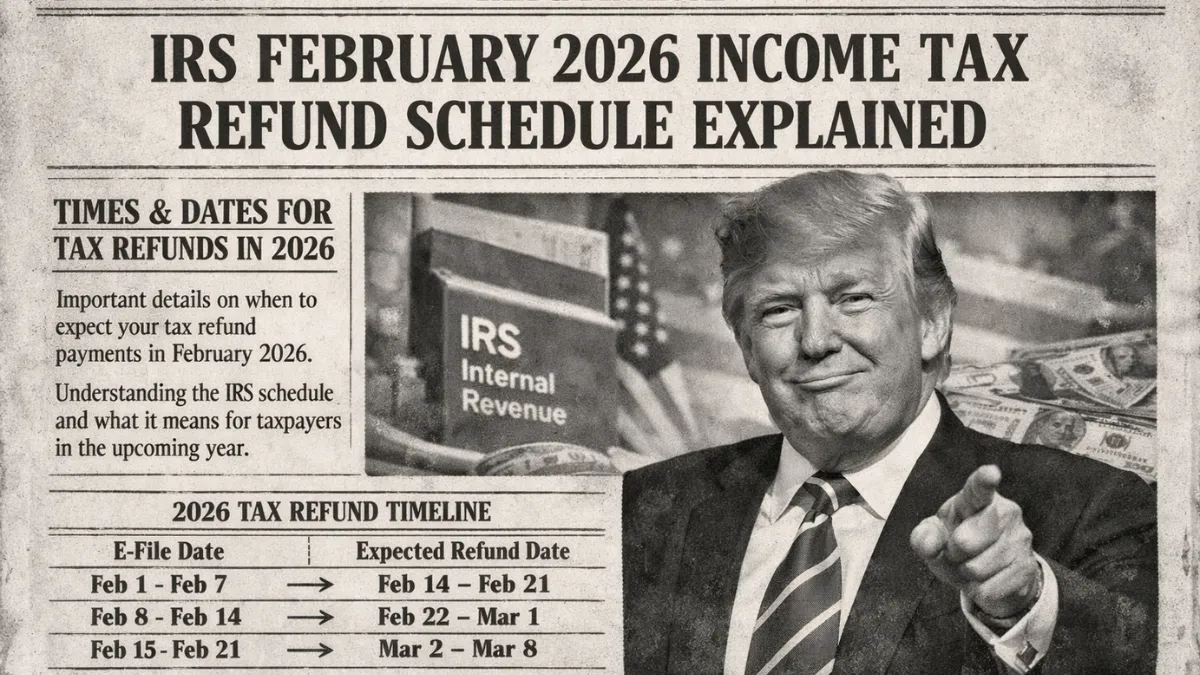

There is no single refund date that applies to everyone. Each tax return is reviewed individually. Refund timing depends on several factors, including how you file and how you choose to receive your payment.

Electronic filing is usually faster because digital returns move through automated systems. Paper returns take longer since they must be manually opened and processed. This can add several weeks to the overall timeline.

Choosing direct deposit is typically the fastest way to receive a refund. Once the IRS approves the return, the refund is sent electronically to the taxpayer’s bank account. Many people receive their money within about three weeks after their return is accepted. However, banks may take one or two business days to post the funds.

Reasons Some Refunds Take Longer

Certain tax credits require additional review to prevent fraud. Returns that claim income-based or family-related credits may not be fully processed until mid-February. Small mistakes, such as incorrect Social Security numbers, missing forms, or mismatched income details, can also cause delays. Carefully checking all information before submitting your return can help avoid these issues.

Taxpayers can monitor their refund progress using the official IRS online tracking tool once their return has been accepted.

Planning Ahead for 2026

Filing early, reviewing your information carefully, and selecting direct deposit are the best steps for receiving a refund as quickly as possible. Being informed about the process helps reduce uncertainty and supports better financial planning.

Disclaimer:

This article is for informational purposes only and does not provide tax, legal, or financial advice. Tax deadlines, refund timelines, and eligibility rules may change. Individual circumstances vary. Always consult official IRS resources or a qualified tax professional for personalized guidance.